The Facts About Palau Chamber Of Commerce Uncovered

Table of ContentsThe smart Trick of Palau Chamber Of Commerce That Nobody is Talking AboutThe Single Strategy To Use For Palau Chamber Of CommercePalau Chamber Of Commerce Fundamentals ExplainedThe Ultimate Guide To Palau Chamber Of CommerceThe 7-Second Trick For Palau Chamber Of CommerceGetting My Palau Chamber Of Commerce To WorkThe Of Palau Chamber Of CommerceNot known Factual Statements About Palau Chamber Of Commerce

For more information, inspect out our short article that speaks more in-depth about the major nonprofit funding sources. 9. 7 Crowdfunding Crowdfunding has come to be one of the essential ways to fundraise in 2021. Consequently, not-for-profit crowdfunding is getting the eyeballs these days. It can be utilized for specific programs within the organization or a general donation to the reason.During this action, you may wish to think of turning points that will indicate a possibility to scale your nonprofit. Once you have actually run for a little bit, it's vital to take some time to think of concrete growth goals. If you haven't currently created them throughout your preparation, develop a collection of vital efficiency indications and also landmarks for your not-for-profit.

Palau Chamber Of Commerce - An Overview

Resources on Starting a Nonprofit in numerous states in the US: Beginning a Nonprofit FAQs 1. Exactly how much does it cost to begin a nonprofit company?

Unknown Facts About Palau Chamber Of Commerce

With the 1023-EZ type, the handling time is typically 2-3 weeks. Can you be an LLC as well as a not-for-profit? LLC can exist as a nonprofit minimal obligation firm, however, it should be completely had by a single tax-exempt nonprofit company.

What is the distinction between a foundation and also a nonprofit? Foundations are commonly funded by a family members or a corporate entity, but nonprofits are funded with their revenues and fundraising. Structures normally take the cash they started with, spend it, and also after that disperse the cash made from those investments.

Getting The Palau Chamber Of Commerce To Work

Whereas, the money a not-for-profit makes are utilized as running expenses to fund the company's mission. Nevertheless, this isn't always true in the case of a structure - Palau Chamber of Commerce. 6. Is it difficult to begin a not-for-profit company? A nonprofit is a service, however starting it can be quite extreme, requiring time, clarity, and also money.

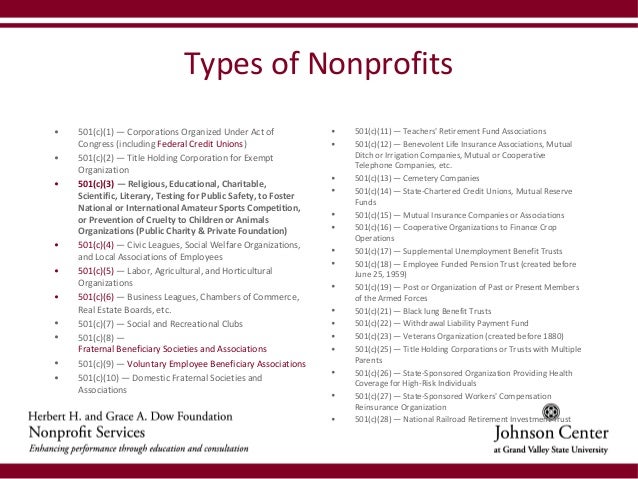

There are several actions to start a nonprofit, the barriers to entrance are reasonably couple of. 7. Do nonprofits pay tax obligations? Nonprofits are excluded from government earnings taxes under area 501(C) of the IRS. Nonetheless, there are particular circumstances where recommended you read they might need to pay. For example, if your nonprofit earns any type of revenue from unconnected tasks, it will owe earnings tax obligations on that quantity.

The Buzz on Palau Chamber Of Commerce

By much the most usual type of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the part of the tax code that licenses such nonprofits). These are nonprofits whose objective is philanthropic, religious, instructional, or scientific.

Palau Chamber Of Commerce - Questions

The bottom line is that private foundations get much worse tax obligation therapy than public charities. The primary distinction between exclusive foundations and public charities is where they obtain their financial backing. A personal foundation is commonly regulated by a private, household, or corporation, and also gets the majority of its income from a couple of donors and investments-- an example is the Expense as well as Melinda Gates Structure.

7 Simple Techniques For Palau Chamber Of Commerce

This is why the tax legislation is so difficult on them. Many foundations simply provide money to other nonprofits. Somecalled "operating foundations"operate their very own programs. As a practical matter, you require a minimum of $1 million to begin a private foundation; or else, it's not worth the problem as well as cost. It's not shocking, then, that an exclusive foundation has actually been defined as a huge body of cash bordered by people that desire a few of it.

Various other nonprofits are not so lucky. The internal revenue service initially assumes that they are private structures. However, a new 501(c)( 3) company will certainly be classified as a public charity (not an exclusive foundation) when it makes an application for tax-exempt status if it can view it now reveal that it fairly can be expected to be publicly sustained.

The Single Strategy To Use For Palau Chamber Of Commerce

If the IRS categorizes the not-for-profit as a public charity, it maintains this standing for its first five years, no matter the public support it in fact obtains throughout this time. Palau Chamber of Commerce. Beginning with the not-for-profit's sixth tax obligation year, it should show that it fulfills the general public support examination, which is based upon the assistance it receives throughout the current year as well as previous 4 years.

If a nonprofit passes the test, the internal revenue service will remain to check its public charity standing after the very first 5 years by needing that a completed Arrange A be submitted every year. Palau Chamber of Commerce. Discover even more regarding your nonprofit's tax condition with Nolo's publication, Every Nonprofit's Tax Guide.